Taxes

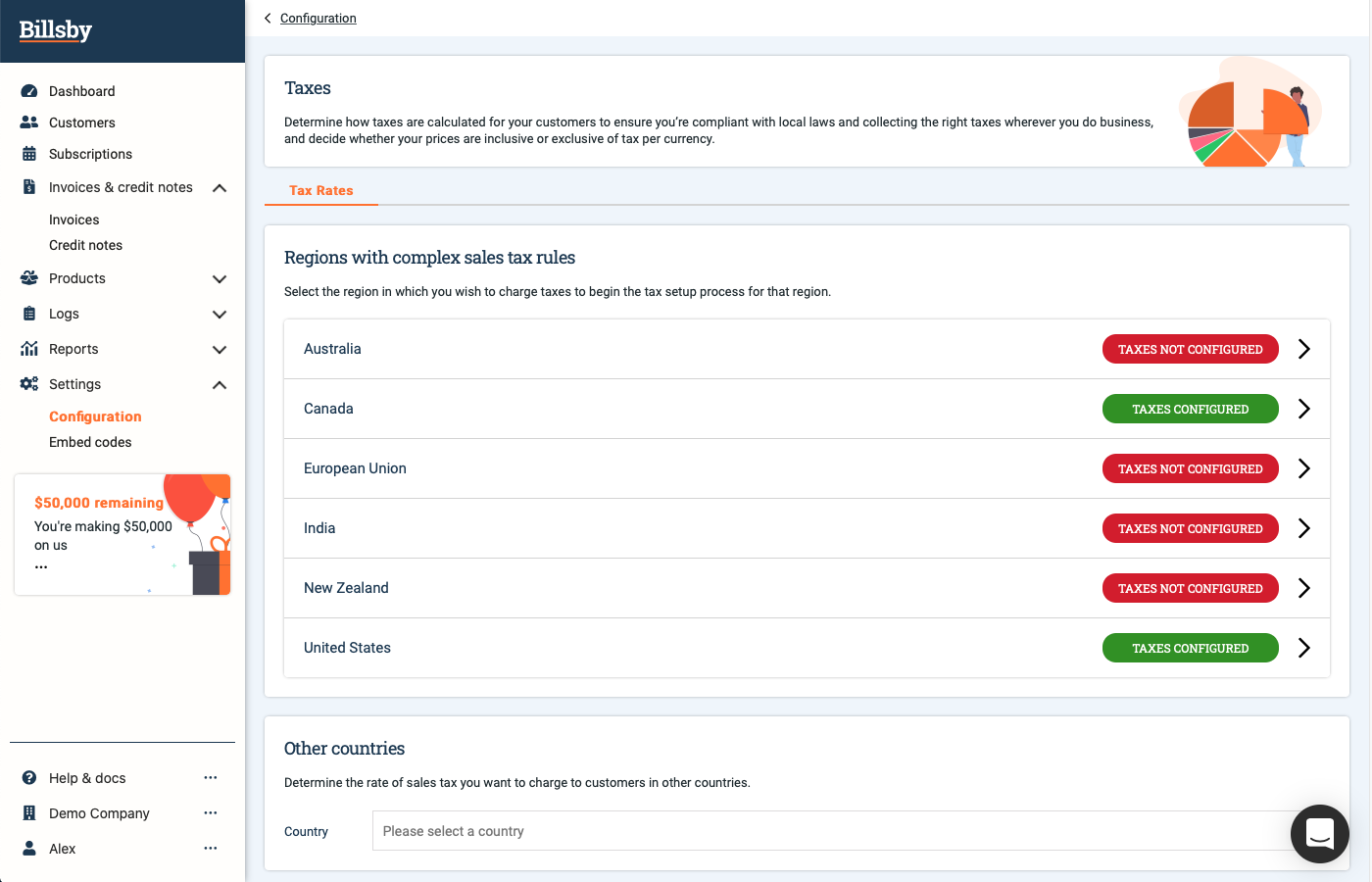

Tax law is complicated. We've helped to make it easier with support for taxes in:

- United States

- Canada

- European Union*

- Australia

- New Zealand

- India

Plus, we support flat rate taxes for the rest of the world.

We've gone deep on these integrations. For example, for customers in the European Union we fully support VAT MOSS, and for customers in Australia we can validate tax numbers and collect the proof points you need to zero charge.

Furthermore, for countries that have specific naming conventions for invoices, we've added the ability to define a custom title to replace 'Invoice' in the top right corner of the invoices we send.

In your taxes configuration you're able to determine how taxes are calculated for your customers to ensure that you're compliant with local laws and collecting the right taxes wherever you do business.

How you configure your taxes in Billsby is dependent on the region in which you're setting up. For the USA and Canada you can integrate a TaxJar account. For these countries, you can also utilise automatic tax calculations by Billsby.

This is a feature that we offer that allows you to simply input your tax information and leave us to do the rest. For other countries, you can manually configure tax rates so you just need to outline what the tax is and how much we need to charge.

Our product team are always monitoring developing regulatory frameworks and identifying opportunities to simplify tax processing for you in the future, elsewhere in the world too. So, get in touch if you have any suggestions for us regarding taxes.

FAQ's

Are individual subscription elements taxed separately?

No, at present, because we're a subscription-based service, we calculate taxes on the cost of your customer's invoice as a whole. Meaning we don't separately calculate the taxable amount based on each individual subscription element. So add-ons, setup fees, and any other additional fees you charge together will go towards the taxable amount as a whole.

How is shipping cost handled when calculating taxes?

Currently, we don't support shipping and fulfillment at Billsby, so we'll always calculate the sales tax for your customer's order with a shipping cost of $0. As there are a number of States where shipping charges are taxable, it's important if you ship physical products to discern the laws around taxable shipping in your state, and other states in which you have sales tax nexus.

In the majority of states, shipping charges are taxable as a part of the item regardless of whether the charge is a part of the price of the item, or if it's listed separately whilst, in some states, shipping charges are not taxable if you show the charge separately from the price of the item.

Creating an add-on for shipping charges in Billsby will result in the cost of the add-on being subject to tax along with all other subscription elements.

For further guidance on how each state handles shipping charges, check out this post by TaxJar. If you're unsure of how best to charge shipping costs with these limitations, please talk to a representative in your state.

Updated about 3 years ago