QuickBooks Online

QuickBooks Online is a cloud-based accounting software solution that allows you to manage your business finances anywhere, anytime. The QuickBooks Online integration simplifies the accounting process by automatically syncing invoices, credit notes, payments, taxes and other associated data from your Billsby account to your QuickBooks Online account. To ensure you get a complete view of your business finances in real-time we sync manual updates to the status of any invoice made in Billsby.

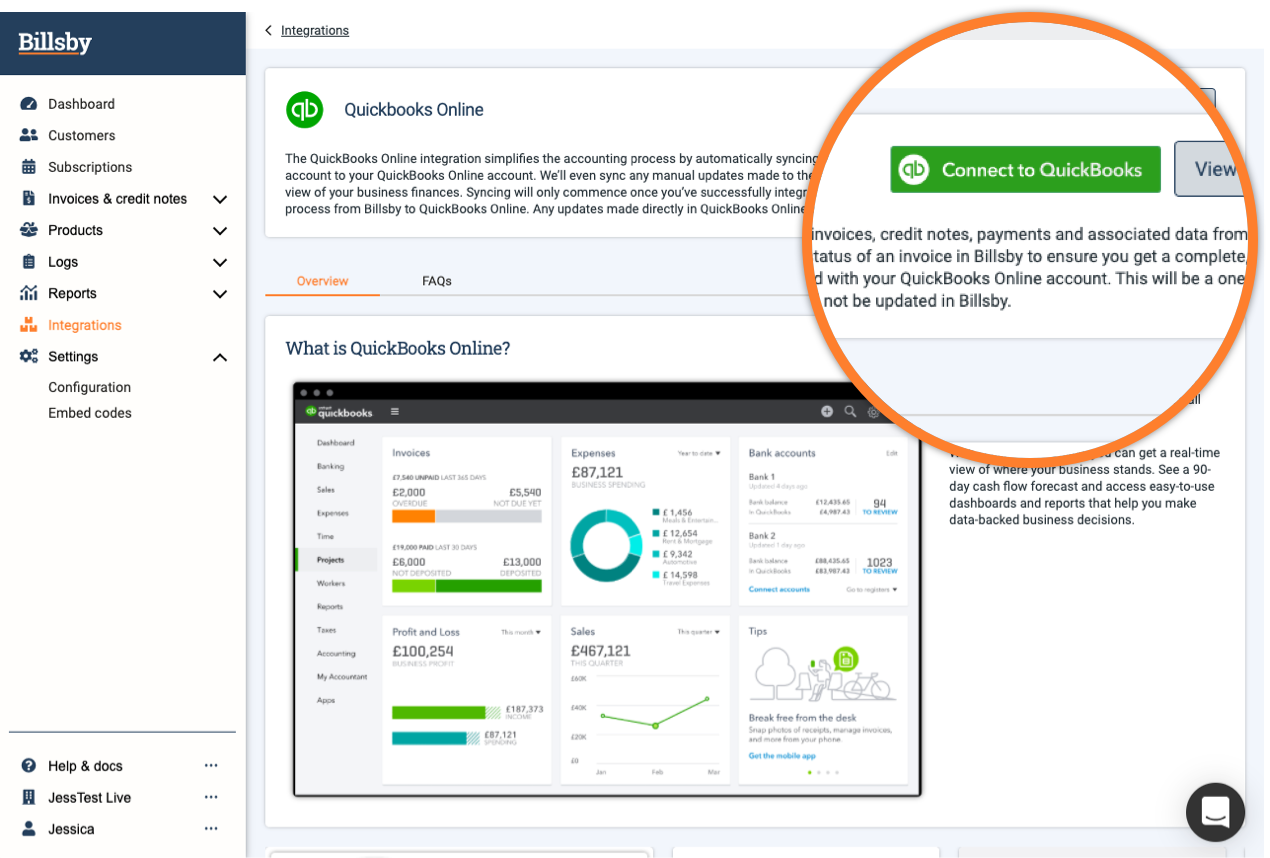

Integrating with QuickBooks Online

To integrate with your QuickBooks Online account, navigate to Integrations > QuickBooks Online. Then, click on the ‘Connect with QuickBooks’ button in the top right of the screen.

QuickBooks Online pre-integration screen

This will redirect you to QuickBooks Online and begin the OAuth process. Here, you will need to log into your QuickBooks Online account and grant Billsby permission to integrate with it.

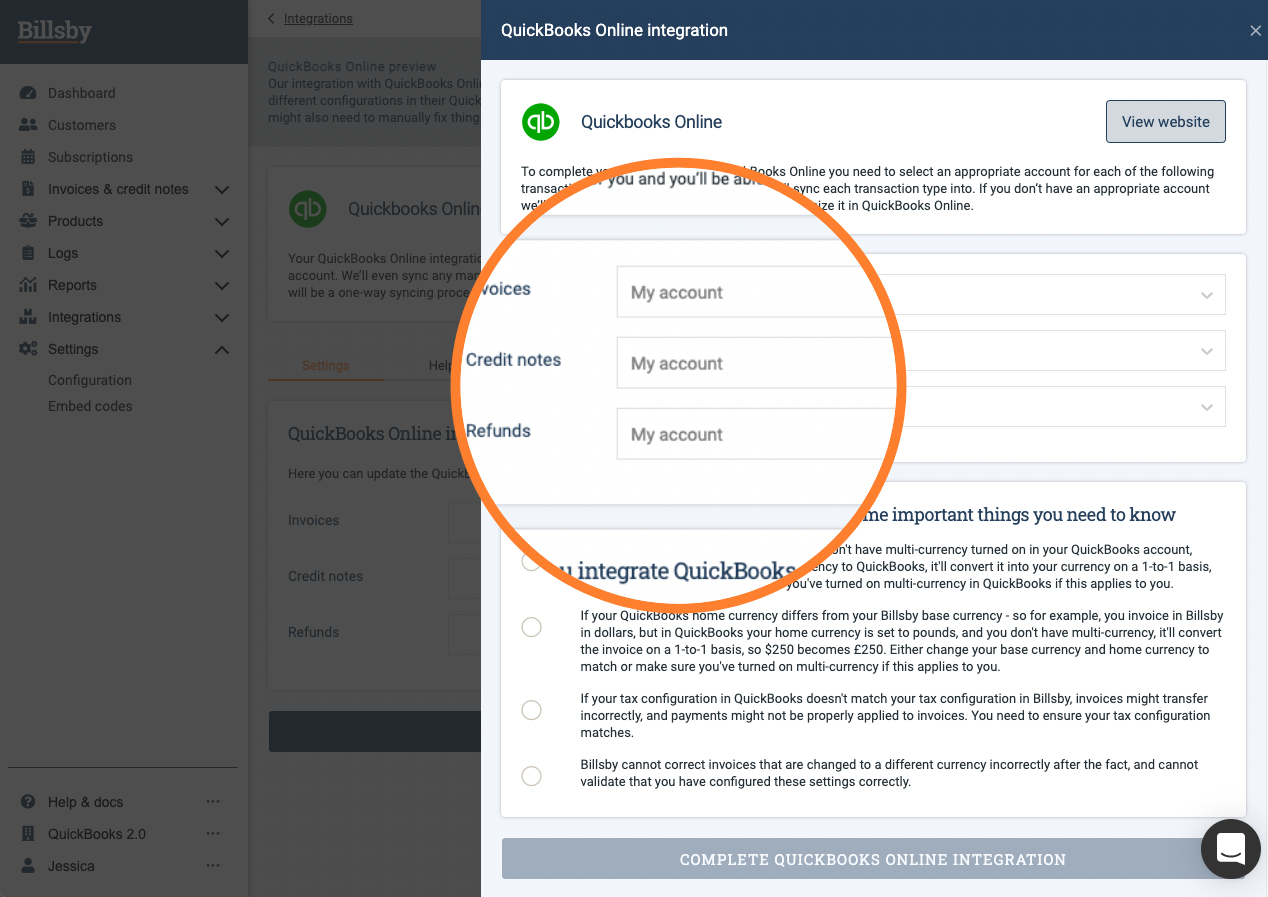

Once you’ve completed these steps, you’ll be directed back to Billsby where you’ll need to assign an account to each of the transaction types that will be synced from Billsby to QuickBooks Online.

The transaction types included are invoice payments, credit note payments and refunds.

Modal for assigning accounts to the transaction types

If you don’t have an appropriate account for one or more of the transaction types, you can ask us to create one for you rather than leaving the integration process. If asked, we’ll create accounts with the following account type and name for each of the transaction types:

- Invoices - OtherCurrentAssets account - Billsby Invoice Revenue

- Credit notes - OtherCurrentAssets account - Billsby Credit Note Expenses

- Refunds - OtherCurrentAssets account - Billsby Refund Expenses

You have the option to change which accounts are synced to your transactions after you have completed the integration process and, rather than manually creating a new account for each transaction type in QuickBooks Online, we can do it for you directly.

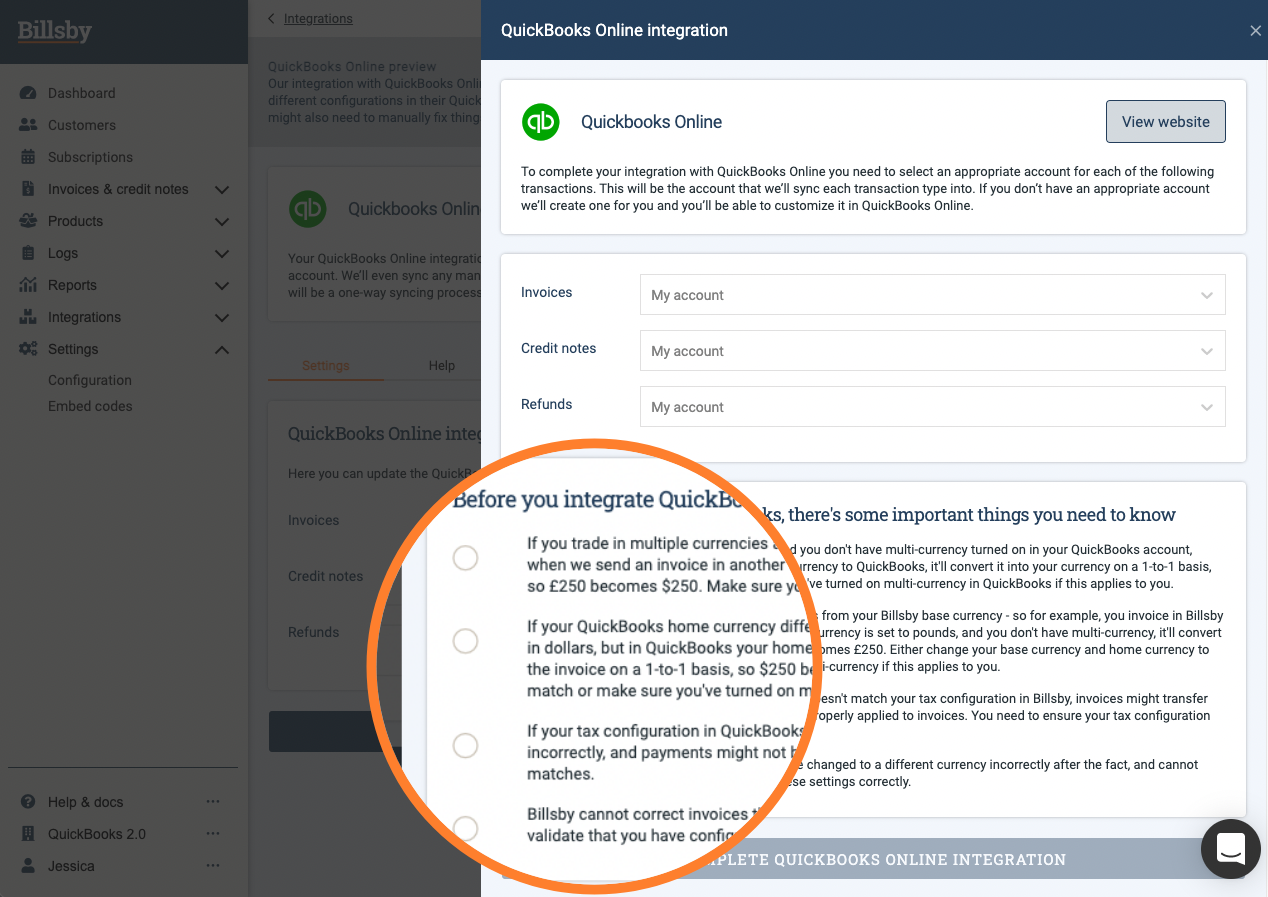

You'll also be asked to confirm your currency and tax configuration settings before completely your integration.

If you trade in multiple currencies, or have multiple currencies set up in Billsby, we'll ask you to confirm that you've turned on your multi-currency setting in QuickBooks Online. Without this setting turned on in your QuickBooks Online account, when we send an invoice in another currency to your QuickBooks Online account it’ll convert it into your home currency on a 1-to-1 basis, so $250 becomes £250. We'll also get you to confirm that your home currency in QuickBooks Online matches your base currency in Billsby. If your QuickBooks home currency differs from your Billsby base currency - so for example, with Billsby you invoice in dollars, but in QuickBooks your home currency is set to pounds, and you don't have multi-currency, it'll convert the invoice on a 1-to-1 basis, so $250 becomes £250.

With your taxes, any tax rates applied to your invoices or credit notes in Billsby will be created in your QuickBooks Online account. Before we can successfully do this however, you'll need to make sure that your tax configuration in QuickBooks matches your tax configuration in Billsby. If your tax configuration does not match, invoices might transfer incorrectly, and payments might not properly applied to your invoices.

QuickBooks Online currency and tax configuration confirmation

Once you’ve completed all these steps your integration will be ready, and we’ll start syncing data to your QuickBooks Online account immediately.

What data will be synced to my QuickBooks Online account?

This is a one-way integration from Billsby to QuickBooks Online. Any updates made in your

QuickBooks Online account will not be synced back to your Billsby account.

Customers

The first time we sync an invoice or credit note relating to a specific customer, we also sync their information as a new contact in your QuickBooks Online account as well. This allows us to assign any invoices and credit notes sent to that customer to their corresponding QuickBooks Online account.

The customer information that will be synced from your Billsby account into your QuickBooks Online account includes their:

- Name - First and last name followed by their Billsby customer ID. The customer ID is a unique set of alpha-numeric characters used to identify customers who may have the same name and currency. For example, John Smith [AAABBB123] (USD), John Smith [CCCDDD123] (USD).

- Email address

- Billing address

- Currency - The currency used to make payments with Billsby, as outlined in their first invoice or credit note. Since customers can only be assigned one currency in QuickBooks Online all customer names include their first name, last name, Billsby ID and the customer's assigned currency code. For example, John Smith [AAABBB123] (USD). This means that if you have a customer that is billed in multiple currencies in Billsby, a new customer will be created for each currency in your QuickBooks Online account.

Invoices

Invoices that are created for a customer in your Billsby account will also be created for the corresponding contact in your QuickBooks Online account. When an invoice is created in QuickBooks Online its status will be set to 'Open' and it's due date will be set to exactly one month after it was created. If the status of an invoice is updated in Billsby, the new status will be synced to the invoice in your QuickBooks Online account for both manual and automatic updates.

To make sure that your customer only receives notifications about their invoice from Billsby, we turn off all email notifications for invoices in your QuickBooks Online account.

Please note that invoices cannot be voided in QuickBooks Online via the API, but for more information on how to void an invoice in your QuickBooks Online account, refer to the section on ‘Written-off invoices' below.

Credit notes

Credit notes that are issued to a customer in your Billsby account will also be created for the customer in your QuickBooks Online account as a credit memo, but only once it has been paid.

Only paid credit notes will be synced to QuickBooks Online, so all credit memos that are created through the Billsby integration will be assigned the status 'paid'. When a credit memo is created in QuickBooks Online it will be assigned to the customer and can be accessed in their 'Transaction list'.

To make sure that your customer only receives notifications about their credit note from Billsby, we turn off all email notifications for credit memos in your QuickBooks Online account.

Payments - invoices and credit notes (non-refund)

All payments made in your Billsby account will be synced to your QuickBooks Online account. These will be synced to the transaction account you appointed for invoice payments and credit notes payments during the QuickBooks Online integration process.

When an invoice payment is made in Billsby, the invoice it relates to is marked as ‘Paid’. We’ll also update the status of the invoice in your QuickBooks Online account to ‘Paid’ at invoice level and marked as 'Deposited' in your list of invoices.

Only paid credit notes will be synced to QuickBooks Online, so when a credit note payment is made in Billsby both the credit note and the payment will be synced to QuickBooks Online at the same time.

Refunds - credit notes refunding invoices

With Billsby, when a customer is issued a credit note as a refund of an invoice any payments associated with the credit note will be synced to your QuickBooks Online account as a refund. Refunds will be synced to the transaction account you appointed during the QuickBooks Online integration process.

Only paid credit notes will be synced to QuickBooks Online so when a refund payment is made in Billsby both the credit note and the payment will be synced to QuickBooks Online at the same time.

Written-off invoices

During the integration process, a Bad Debts line item will be automatically created as a non-stock item in the Product and Service section of your QuickBooks Online account.

In the event of an invoice being written-off in Billsby, we will create a credit memo with the Bad Debt line item in your QuickBooks Online account and match it to the written-off invoice. This will apply credits to the invoice, to the value of the invoice to offset its balance. Once we've done this, a '0' payment will be processed to mark the invoice as 'paid' at invoice level and as 'Deposited' in your list of invoices.

Recovered invoices

With Billsby, when a written-off invoice is paid and recovered we’ll delete the associated credit memo used to write-off the invoice in your QuickBooks Online account. This will automatically remove the credits and payment applied to the invoice in QuickBooks Online changing it's status to ‘Open'.

The invoice payment from Billsby will then be synced to the transaction account you appointed during the QuickBooks Online integration process. The status of the invoice will also be updated to 'Paid' in your QuickBooks Online account.

Taxes - tax mapping

Any tax rates applied to your invoices or credit notes in Billsby will be created in your QuickBooks Online account in the following format: Billsby - [TaxRate].

So, for example, if your invoice had a 20% sales tax applied to it, the tax rate would be created in QuickBooks Online as 'Billsby - 20%'. Since we map tax rates directly from invoices and credit notes raised in Billsby, you’ll still be able to use TaxJar or Automatic Tax Calculations by Billsby to configure your taxes in complex tax regions.

Before we can successfully map taxes, you'll need to make sure that your tax configuration in QuickBooks matches your tax configuration in Billsby. If your tax configuration does not match, invoices might transfer incorrectly, and payments might not properly applied to your invoices.

Limitations

There are a few limitations to note with the QuickBooks Online integration. These are as follows:

Data syncing

This is a one-way integration from Billsby to QuickBooks Online. Any updates made in your QuickBooks Online account will not be synced back to your Billsby account.

Data syncing will only commence once you’ve successfully integrated with your QuickBooks Online account. Any invoices, credit notes, payments, taxes or associated data collected in Billsby prior to your integration will not be synced.

Customer data

We will not sync any customer deletions in Billsby to your QuickBooks Online account. Deletions will need to be done manually.

Customers created in QuickBooks Online can only be assigned one currency. If you have a customer that is billed in multiple currencies in Billsby, a new customer will be created for each currency in your QuickBooks Online account. The currency tag will appear at the end of each customer’s name to distinguish which currency the customer is billed in (see currency bullet point above).

Credit notes - invoice refunds

Credit notes are only synced to QuickBooks Online once they've been paid in Billsby. If a credit note is marked as 'Unpaid' in your Billsby account it will not be synced to your QuickBooks Online account.

When a customer’s invoice is refunded, the credit memo is matched to the invoice in QuickBooks Online. These will still show as separate documents in your QuickBooks Online account, but you can see the link in the payment entry.

Payments and refunds

When syncing payments and refunds to your QuickBooks Online account, we can only sync these to accounts with the type 'OtherCurrentAssets' and 'Bank'.

Taxes

When we create a tax rate in your QuickBooks Online account it gets labelled as follows, Billsby - [TaxRate]. This label format will appear on invoices and credit memos created in QuickBooks Online. We will not sync the tax label used on your Billsby invoices and credit notes.

Before we can successfully map taxes, you'll need to make sure that your tax configuration in QuickBooks matches your tax configuration in Billsby. If your tax configuration does not match, invoices might transfer incorrectly, and payments might not properly applied to your invoices.

Multi-currency

If you trade in multiple currencies, or have multiple currencies set up in Billsby, we recommend turning on the multicurrency feature in your QuickBooks Online account. Without this feature, when we send an invoice in another currency to your QuickBooks Online account it’ll convert it into your home currency on a 1-to-1 basis, so $250 becomes £250.

It is also important that your home currency in QuickBooks Online matches your base currency in Billsby. If your QuickBooks home currency differs from your Billsby base currency - so for example, with Billsby you invoice in dollars, but in QuickBooks your home currency is set to pounds, and you don't have multi-currency, it'll convert the invoice on a 1-to-1 basis, so $250 becomes £250.

Custom transaction numbers

To make sure your invoices that are synced to your QuickBooks Online account are numbered in line with your transactions you'll need to manually turn on the 'Custom transaction numbers' setting. Without this, we'll be unable to use the API to number your invoices and any invoices synced into your account will not be numbered. You can find this setting by navigating to Account and settings > Sales > Sales form content.

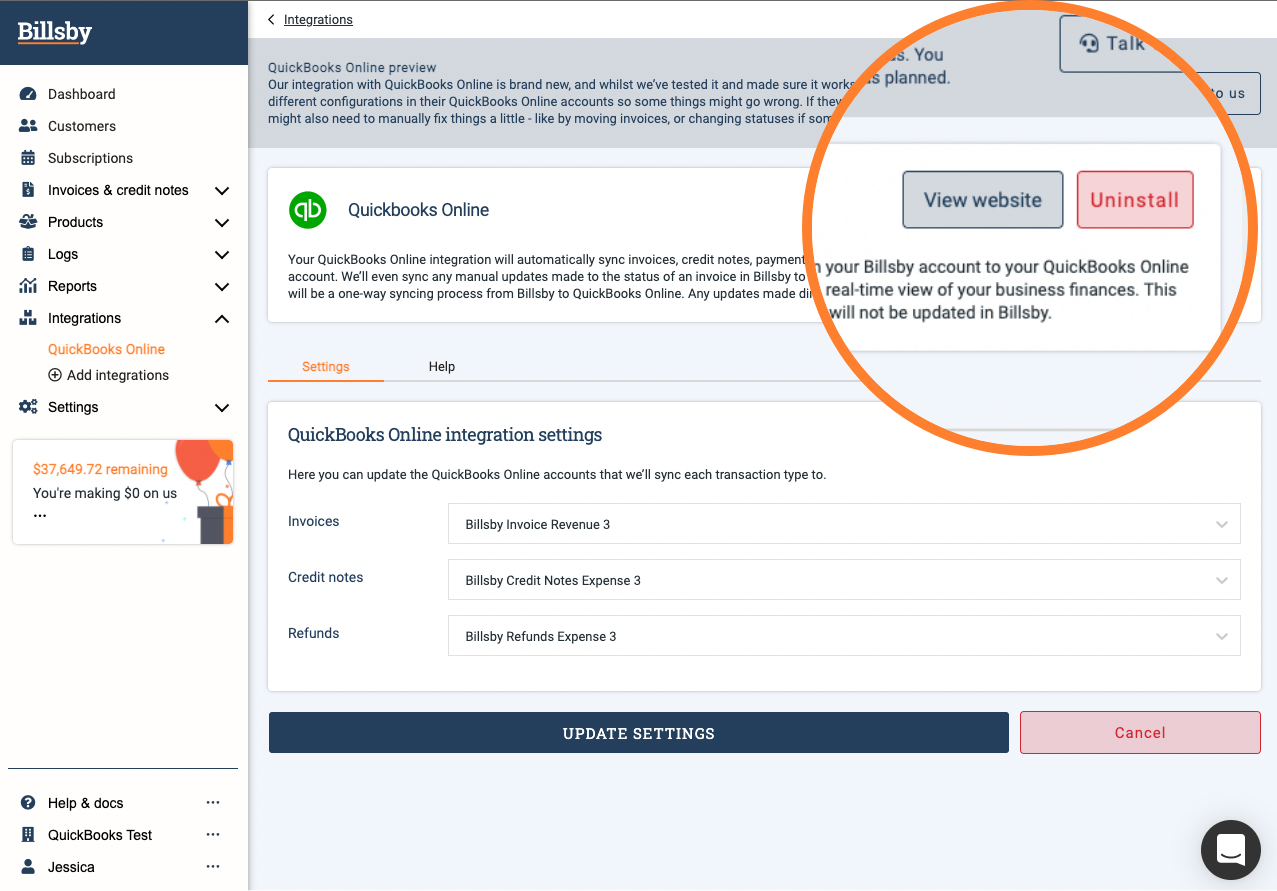

Uninstalling QuickBooks Online

You can choose to uninstall your QuickBooks Online integration at any point on your QuickBooks Online integration page. When you uninstall the integration all invoice, credit note, payment, tax and associated data will stop syncing to your QuickBooks Online account.

QuickBooks integration page

You can also choose to uninstall your integration from within your QuickBooks Online account. However, if you choose to do this and immediately navigate into your Billsby account, it may still appear to be connected to QuickBooks Online.

We will only be able to show the uninstallation of the integration in Billsby after we've attempted to sync a piece of data to your QuickBoos Online account and the connection has failed. To avoid this confusion, we recommend that if you choose to uninstall your QuickBooks Online integration, that you do so from within your Billsby account.

Once you uninstall the integration all invoice, credit note, payment and associated data will stop syncing to your QuickBooks Online account.

However, any data that was previously synced will remain in your QuickBooks Online account.

FAQs

How do I subscribe to QuickBooks Online and what information do I need to sign up?

Getting started with QuickBooks Online is an easy process with their 30-day free trial period. Just enter your name, email address and choose a password and you’re good to go - QuickBooks Online doesn’t ask for any payment details during a trial. After the trial period is over, however, you will be asked to provide some basic details about your business. QuickBooks Online will use this to gather information from over 500,000 businesses around the globe to configure your QuickBooks Online file which you’ll then be able to customise and update as you go.

Will be data be secure in QuickBooks Online?

We sync all invoices, credit notes, payments and refunds that are transacted within Billsby. We also need to sync any customer names, email addresses and billing addresses that are associated with the invoices, credit notes, payments and refunds. QuickBooks Online takes security very seriously and ensures your data is secured and available to you. If you decide to cancel your QuickBooks Online subscription during the free 30-day trial, they’ll delete all traces of your data from their servers immediately. If you’re a paying QuickBooks Online subscriber and you choose to cancel your subscription then you’ll be given read-only access to all your data after you cancel. This will last for 365 days, after which it will be deleted from QuickBooks Online and all of their servers. You can find more information on this here.

Will taxes be mapped from my TaxJar integration to QuickBooks Online?

Yes. The tax rate applied to any invoice or credit note will be created in your QuickBooks online account with the following label, Billsby - [TaxRate]. So, for example, if your invoice had a 20% sale tax applied to it, the tax rate would be created in QuickBooks Online as Billsby - 20%.

Before we can successfully map taxes, you'll need to make sure that your tax configuration in QuickBooks matches your tax configuration in Billsby. If your tax configuration does not match, invoices might transfer incorrectly, and payments might not properly applied to your invoices.

Will taxes be mapped from the Automatic tax calculations from Billsby to QuickBooks Online?

Yes. The tax rate applied to any invoice or credit note will be created in your QuickBooks online account with the following label, Billsby - [TaxRate]. So, for example, if your invoice had a 20% sale tax applied to it, the tax rate would be created in QuickBooks Online as Billsby - 20%.

Before we can successfully map taxes, you'll need to make sure that your tax configuration in QuickBooks matches your tax configuration in Billsby. If your tax configuration does not match, invoices might transfer incorrectly, and payments might not properly applied to your invoices.

What happens if I bill customers in multiple currencies?

If you trade in multiple currencies or have multiple currencies set up in Billsby, we recommend turning on the multicurrency feature in your QuickBooks Online account. Without this feature, when we send an invoice in another currency to your QuickBooks Online account it’ll convert it into your home currency on a 1-to-1 basis, so $250 becomes £250.

It is also important that your home currency in QuickBooks Online matches your base currency in Billsby. If your QuickBooks home currency differs from your Billsby base currency - so for example, you invoice in Billsby in dollars, but in QuickBooks your home currency is set to pounds, and you don't have multi-currency, it'll convert the invoice on a 1-to-1 basis, so $250 becomes £250.

Which sheet are my invoices added to in QuickBooks?

When integrating your Billsby account with QuickBooks Online, we use 'OtherCurrentAssets' transaction accounts.

This means that invoices synced from Billsby are added to the balance sheet, rather than the profit/loss sheet.

Updated about 4 years ago