European Union

Manually add tax rates

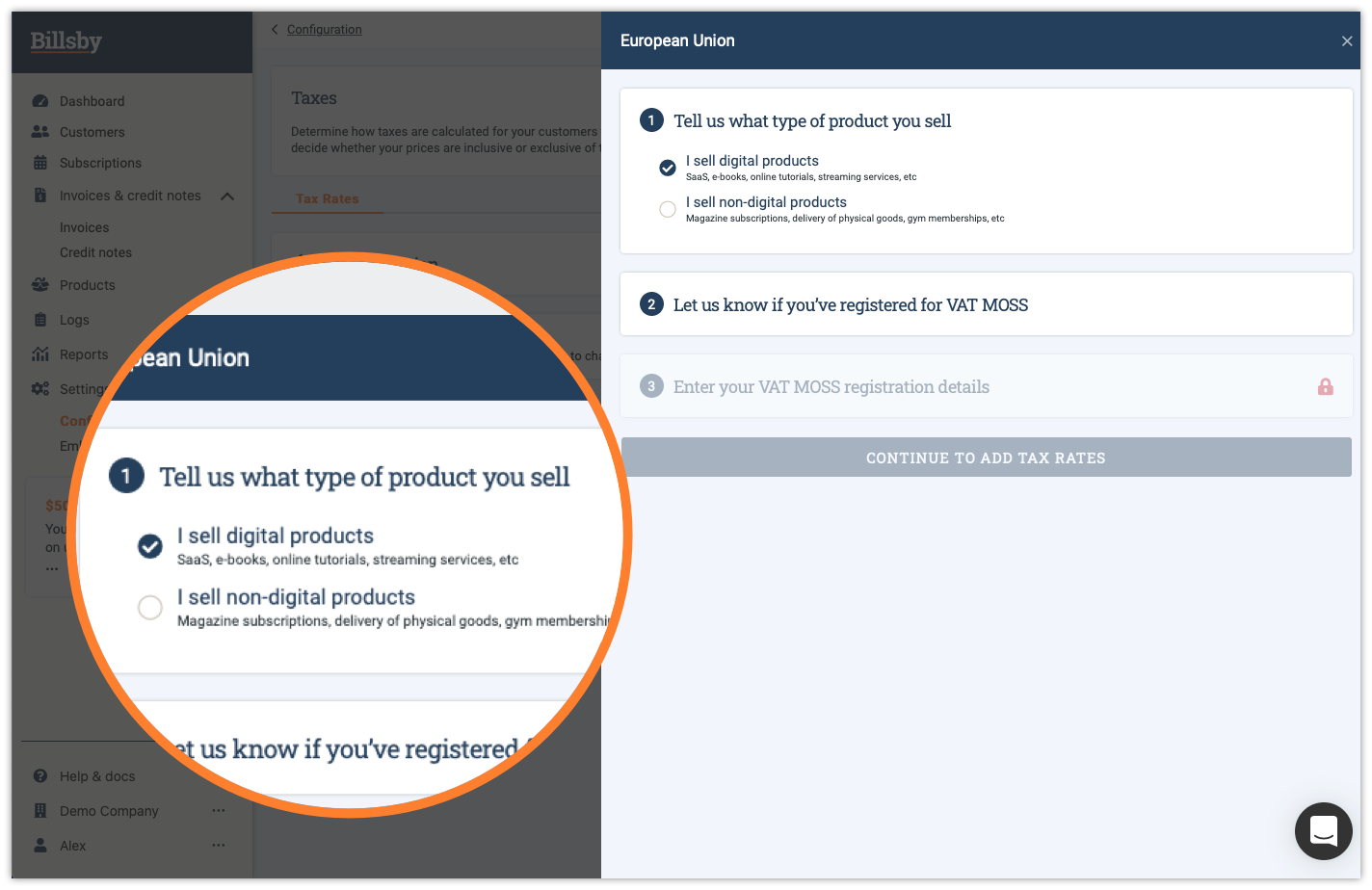

Due to the complexities regarding different member states, additional information is required when you are manually configuring your taxes for the EU.

We have a three step process to make sure that you'll be charging the right amount for the product you're selling. First, you will need to select the product type you are selling: either digital or non-digital. For digital products we require information about your VAT MOSS registration status. If you are registered, we will also require your VAT MOSS details. For non-digital products you bypass these steps.

The VAT Mini One Stop Shop (MOSS) is an optional scheme that allows you to account for VAT - normally due in multiple EU countries – in just one EU country. You can find out more about VAT on digital services on the European Union website.

You will need to add tax rates for each of the European Union countries that you wish to complete configuration for. Once you have determined whether you want us to collect a tax registration number, we have two validation options that you are able to switch on, as follows:

Location validation

If you turn this toggle on we will validate your customers location using their billing address as well as their IP address to ensure that they are where they say they are.

VAT validation

If you turn this toggle on we will validate your customers' VAT number against the VAT Information Exchange System. If we successfully validate your customers' VAT number, then they will become exempt from paying VAT on their subscription.

The VIES can help companies to prove to the Tax Administration department that they have successfully validated a customer's VAT number at a certain time. If you switch this toggle on we will generate a VAT consultation number using VIES.

A VAT exemption note will be applied to your customers invoice if goods are exported to countries outside the EU, as per Article 146 of the EU VAT Directive. You can customise the note in the text box by clicking the 'Edit' button.

FAQs

Is 0% a valid tax rate of VAT ?

0% tax rate is a valid tax rate that is used by some countries (primarily in the EU region) to distinguish between exempt and taxable goods. A reduced rate, <5%, and sometimes “0% (zero-rated) tax” is applied on certain goods by the EU member states. This rate is considered as a taxable rate of VAT and the revenue generated from zero-rated goods (applicable only to selected items) is still included in the taxable revenue. In the case of “exempt” supplies, businesses cannot register for VAT and are not entitled to a VAT reclaim on their business expenditure.

Updated almost 5 years ago